The Finance Minister of India, Nirmala Sitharaman, revealed the Union Budget 2023 on 1st February 2023. In her 1 hour 25-minute speech, Sitharaman presented Seven priorities of the budget 2023, i.e., Inclusive development, Reaching the last mile, Infra & investment, Unleashing the potential, Green growth, Youth power and Financial sector

Citizens anticipated several populist measures from Budget 2023 and a roadmap that would support India's $5 trillion economy goal. With enhanced Capex, infrastructure upgrades and incentives for key sectors, it is no longer a lofty goal but an actionable plan ready for deployment.

Here follows a detailed reading of the various measures:

Relief for MSMEs : In case of failures by MSMEs to execute contracts during the Covid period, 95% of the forfeited amount relating to the bid/ performance security will be returned to them by the government / government entity.

Eklavaya Model Residential Schools: In the next 3 years the Centre will recruit 38,800 teachers and support staff for 740 schools serving 3.5 lakh tribal students.

Capital Booster for Indian Railways: Capital outlay of Rs 2.40 lakh crore will be provided for railways; 9 times of FY14 capital outlay.

PM Aawas Yojana: The outlay for PM Aawas Yojana is being enhanced by 66% to over 79000 Crores.

Digilocker- One stop KYC maintenance system: For business establishments required to have PAN, the PAN will be used as a common identifier for all Digital Systems of specified government agencies.

Overall Capex outlay: Overall Capital expenditure outlay is being increased by 33% to 10 lakh crore — 3.3% of GDP. This will be 3 times the outlay in FY19.

Companies Act: Central Processing Centre (CPC) will be setup for faster response to companies for centralized handling of various forms filed under companies act.

Mahila Samman Saving Certificate- a one-time new small saving scheme

- To be launched for 2 years period upto March 2025.

- Deposit facility upto Rs. 2 lakh in the name of women/ girls for 2 years tenure.

- Fixed rate of interest of 7.50% with partial withdrawal option.

Indirect Taxes

1. Customs duty on goods of textiles, toys, bicycle reduced from 21 to 13%

2. To promote Green Mobility - basic customs duty concession for lithium ion battery

3. To promote Electronics manufacture- relief on customs duty for camera lens and lithium battery

4. Television - TV panels customs duty reduced

5. Electric kitchen chimney to reduce inverted duty structure from 7.5 to 15 percent

6. Benefit for ethanol blending program and acid program and epichlorohydrine

7 Marine Products- to promote exports - shrimps, etc. Duty on shrimpfeed reduced

8. Basic Customs duty reduced for seeds in manufacture for diamonds

9. Customs duty to increase in silver bars

10. Steel - concessional customs duty on steel and ferrous products

11. Copper - concessional customs duty on copper

12. Rubber - concessional customs duty on rubber

13. Cigarettes - increased tax

14. Proposed to reduce Basic Custom Duties (BCD) rates on goods other than textiles and agricultural from 21% to 13%.

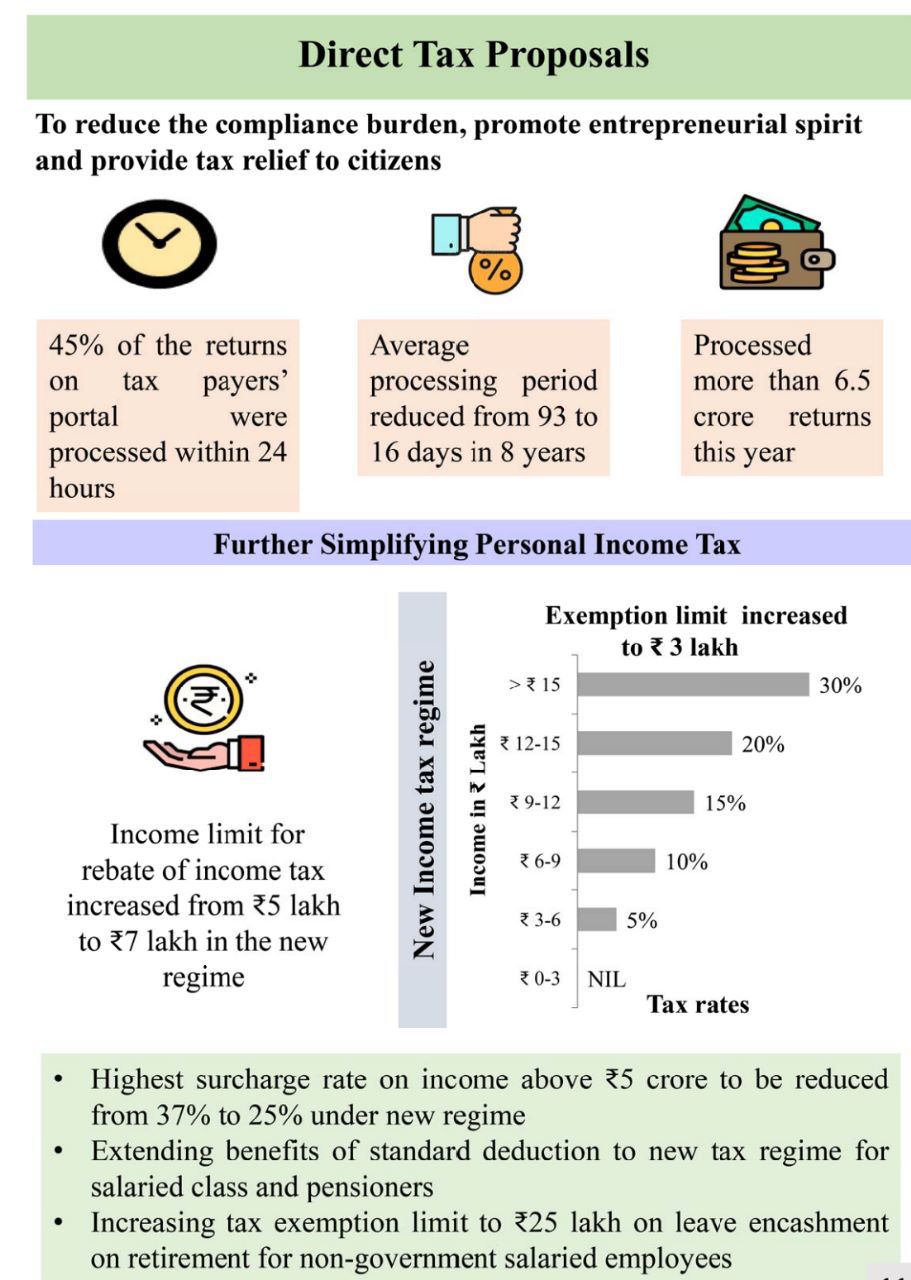

Direct Taxes Proposals:

- To further improve ITR processing & grievance redressal mechanism.

- Sec 44AD limits are enhanced to Rs. 3 Crores provided cash receipts is not more than 5%.

- Sec 44ADA limits are enhanced to Rs. 75 lakhs provided cash receipts is not more than 5%.

- Sec 54-54F capped at 10 crore

Direct Taxes Proposals for start-ups:

- Proposed to extend date of incorporation for startups for claiming tax benefits to 31/03/2024 from existing 31/03/2023.

- Benefit of c/f of losses on change of shareholding is being extended from 7 years of incorporations to 10 years.

Personal Income Tax:

- Proposed to increase the rebate limits upto 7 lakhs from existing 5 lakhs under new tax regime.

- Proposed to increase the tax slab limits under new tax regime:

- 0-3 lakhs- nil

- 3-6 lakhs- 5%

- 6-9 lakhs- 10%

- 9-12 lakhs- 15%

- 12-15 lakhs- 20%

- Above 15 lakhs- 30%

- Salaries class & pensioners: standard deduction benefit available under new tax regime.

- Proposed to reduce highest surcharge rate from 37% to 25% under new tax regime. Thus, maximum tax rate reduced to 39% from 41%.

Fiscal deficit

- Fiscal deficit for FY23 at 6.4% of GDP

- Fiscal deficit target for FY24 at 5.9%

- Fiscal deficit glide path for FY26 is 4.5%

0 thoughts on “Budget 2023 Highlights: Summary of Honorable Finance Minister of India speech”

Leave a Reply

Your email address will not be published. Required fields are marked *

RECENT NEWS

- 'Seen hundreds of such lunatics': Religious body brushes off Pannun’s threat to Maha Kumbh

- Congress that fought for independence and the one ruling Karnataka are different: BJP's Basavaraj Bommai

- Justin Baldoni’s former publicist sues the actor

- 1924 Belgaum Congress session chaired by Gandhiji stands out for its focus on social change

- Deepika shares a pic from daughter Dua's first Christmas